Table of Content

UBL Karobar Loan is an answer for simple access of money expected to develop your business. It is solely intended for little and medium ventures keeping in view their business extension and development plans. UBL Karobar Loan is accessible against home loan of property including private, business and modern. UBL CashPlus is a one of a kind term loan financing product which offers various highlights, choices, and adaptability intended to satisfy your monetary requirements.

Please go through this blog to understand the banking sector of Pakistan and how they deal with home loans. Are you someone who has already received a home loan from any bank? If yes, then do share your personal experiences related to bank loans.

Ubl salary loan apply online

So, all those people who do not want to get involved with any kind of interest can opt for this bank as it provides loans up to Rs.75 million. JS Bank offers home loans ranging from Rs. 500,000 to Rs. 100 million, payable in 12 to 240 monthly installments. Like other banks, Bank Al Habib is also providing a loan starting from Rs. 300,000 to Rs. 20 million, payable in 240 monthly installments. Alfalah Home Finance is giving home loans in Pakistan on easy terms and conditions. You can apply for a loan amount starting from Rs2 million to Rs. 50 million, payable in 36 to 240 monthly installments. All you have to do is pay a certain amount of money every month to the bank.

Just like MCB, the minimum salary requirement for Askari Bank is Rs. 50,000. The age limit is years, and the documents needed for further processing include CNIC, salary slips, and 12-month bank statement. The person should have a monthly salary of Rs. 50,000, and should be years of age. The documents required include CNIC, salary slips, 12-month bank statement, and proof of Pakistani residency.

UBL Address Home Loan Facility (Non-Resident Pakistani)

MCB offers a range of financing options for different purposes including home purchase, renovation, construction or land purchase. Their home finance option is available in all major cities like Lahore, Karachi, Islamabad, Faisalabad, and Rawalpindi. MCB provides up to 20 million loans for a period of 2 to 20 years; however you cannot obtain this loan for commercial properties.

The home loan program of Faysal Bank operates under the diminishing Musharakah principle. In this program, the bank and the customer purchase the asset jointly. The bank then rents out its share of units to the customer. Al-Baraka is giving out loans starting from Rs0.3 million to Rs. 35 million, payable in up to 240 monthly installments. With Meezan Bank, you can apply for a loan amount starting from Rs. 500,000 to Rs. 50 million, payable in 24 to 240 monthly installments.

Bank of Punjab

Below I am giving you some links of banks/companies that provide loans to their customers. There are a number of banks providing different home finance products for their customers and you can avail any of them when buying or constructing your home. This depends on your financial conditions and the business you are doing. This information you will only get by visiting the branch or check online from that bank’s website from which you want to take a loan.

To get a loan from any bank, visit the bank and talk to their representative. You will have to submit your details, financial records and business details to the bank. There are many online calculators like 1 trillion in crores conversion and home loan calculators in Pakistan. If you want to calculate and compare costs, then you can use Home Loan Calculator. When you purchase a home or build a house using the home loan, remember that you will not become the 100% owner of that property.

No matter where in the world you are, there are some legal aspects attached to buying a piece of real estate that you need to look out for. To make the whole endeavor easier for buyers, Zameen introduces Home Loan Calculator. Additionally, there are numerous home/house financing options available in the market with almost every major bank trying to provide the best means to address this pressing issue. Use this tool to evaluate the best house financing option there is. Currently, no bank is providing interest-free loans in Pakistan.

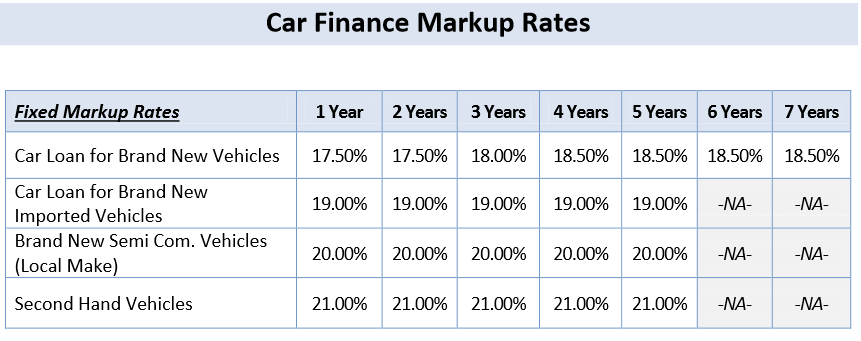

Some banks give you a loan at zero interest rate, but they have complicated terms and conditions, and you have to pay back the amount in a short time. But you can choose any bank which is convenient for you. The interest rate varies from bank to bank, and you can quickly check the interest rate on the internet or by visiting the bank from which you want to get a loan. First of you have a Pakistani national identity card and are 22 years old. Then you have to provide you souse of income like about you salary, business or you say that you are a self-employ.

You can change the cost of construction, income bracket and payback period according to your preference. The primary objective of this article is to educate people about the interest rates, processing fees and basic requirements of every bank. However, building a home in today’s era can be very difficult due to the increasing cost of raw materials, labour, and property tax.

Like any other bank, the UBL also provides a home financial loan program to its customers that want to make their own house. When you get a microfinance loan or a personal loan, you pay it off within 2 to 3 years. But when you sign up for home loans, keep in mind that it will take years to return your loan. If you are ready for this kind of financial commitment, go for a home loan for sure. National Bank of Pakistan also providing home loan to its valuable customers on easy terms and conditions. NBP home loan is providing best home loan rates in Pakistan because of its variable annual return policy.

Suppose you are a Pakistani and want to get a loan to make your home or start your business in Pakistan without any financial problems. You can also visit any bank affiliated with this program and get the form from the bank and fill it. You can benefit from this program easily if you are a Pakistani residential and have a national identity card. The HBL is the most extensive banking network in Pakistan; they have branches in all Pakistan’s leading and small cities.

Through UBL Address Low Cost Housing, all Pakistani’s can own a dream house in Pakistan.

You can easily apply for the PM housing loan scheme in Pakistan. You have to download the form from the NADRA website, fill it, pay the fee, and verify it from the NADRA officer. The Prime Minister House loan scheme is a massive project by the prime minister of Pakistan, Imran Khan. Most of the banks in Pakistan have a tenure of 3 to 25 years. At this time, you will have to pay the entire loan amount; otherwise, you will be extra charged.

No comments:

Post a Comment